Our agency-wide effort to listen to the people we serve

- English

- Español

The CFPB is committed to making financial markets work for all consumers. As a result, we have launched a series of ambitious efforts to improve how we collect information from the public. These efforts will ensure our work is guided by the people we serve.

The Paperwork Reduction Act: Driving improvements in user experience

The Paperwork Reduction Act (PRA) ensures the federal government uses information to strengthen government decision-making with limited public burden. When the government is designing and delivering services, it needs to be inclusive of the lived experience of the people it serves. However, many agencies may be cautious about engaging the public to better understand their experiences for fear that engagement would itself be subject to burdensome requirements.

At the CFPB, we knew users had to come first. We sought paths for effective, responsible user research that aligns with the PRA to improve our products and services. We found that close partnerships with our compliance offices reduced the administrative burden when engaging the public. Recently, the Office of Information and Regulatory Affairs clarified that critical elements of user research are exempt from the regulatory definition of "information" reaffirming the following tools are available to easily engage the public with minimal burden:

- Listening sessions with interested parties

- Asking non-standardized questions on a particular process, theme, or issue (without any specification of the information being sought)

- Directly observing the experiences of participants

These methods allow us to conduct user research quickly, understand consumers’ day-to-day experiences, and protect them more effectively while improving our products and services.

Democratizing talking with users

The CFPB developed an internal policy to solidify these exemptions and empower all employees to conduct research directly with consumers. To democratize research and create a culture focused on the user, we:

- Developed self-serve guidance about how to conduct many types of user research for new and experienced CFPB product owners.

- Launched a Research Operations program to support CFPB product owners through training and guidance.

- Standardized privacy statements in English (recruiting and testing ) and Spanish (recruiting and testing ) to ensure users’ data are protected.

- Procured a usability testing platform with built-in user recruitment tools.

- Released samples of moderator guides, reports, and screener language.

- Created drop-in office hours with user research experts.

- Expanded the use of incentives for participant recruitment.

These innovations created agency-wide pathways for quickly testing new products and ideas. It also provided CFPB employees the ability to lead their own research efforts and enabled us to interact with real users before investing significant agency time and resources. As a result, it’s now possible to identify a problem on our website and gather user feedback the same day to inform possible solutions.

Working in design sprints

To take these user-centered approaches further, the CFPB adopted design sprints, a low-risk, time-efficient process to focus resources and accomplish work quickly using design thinking methods. This process includes forming interdisciplinary teams across the agency for two-week, immersive periods to generate ideas, design and test prototypes, and prepare CFPB website offerings for the public.

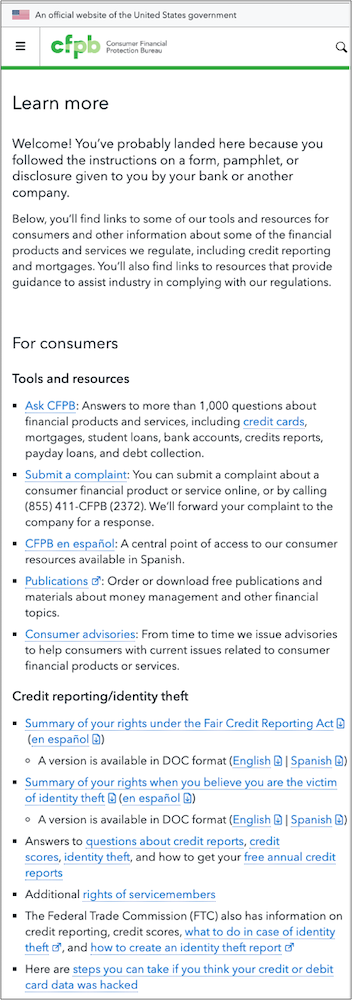

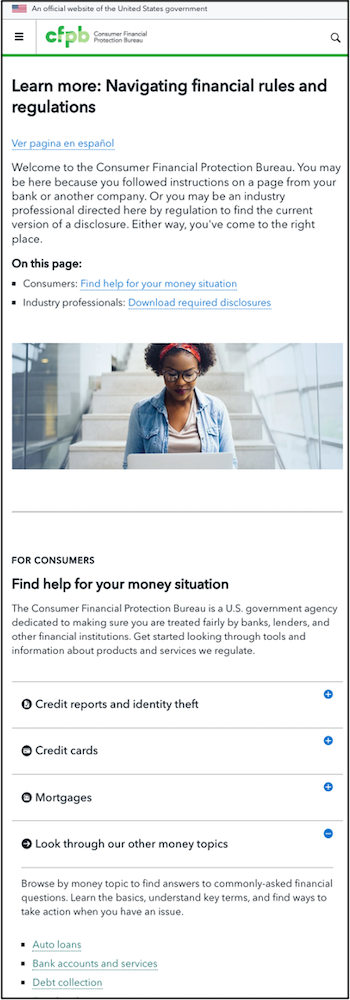

One of our most visited webpages, consumerfinance.gov/learnmore, is included in required disclosures for credit cards, identity theft, and credit reporting. Users who visit this page are likely looking for help and information on their rights as consumers. Thus, we needed to understand how users experience this page and ensure our resources are accessible and relevant.

After conducting user interviews in English and Spanish, and quickly mocking up new prototypes between sessions, the CFPB launched its new Learn More page just two weeks later. Since the relaunch, we've seen increased numbers of users clicking through to other pages and a noted decreased time spent on the page itself - all good signs that users can find what they need. Verifying whether these changes are effective can be accomplished with additional user testing.

Before

After

What’s next?

Actively listening to the people we serve is just good government. While our recent innovations have led to exciting changes at the CFPB, we recognize this work is just the beginning. We’re committed to making our services more equitable and effective by listening to the needs of the American public.